Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

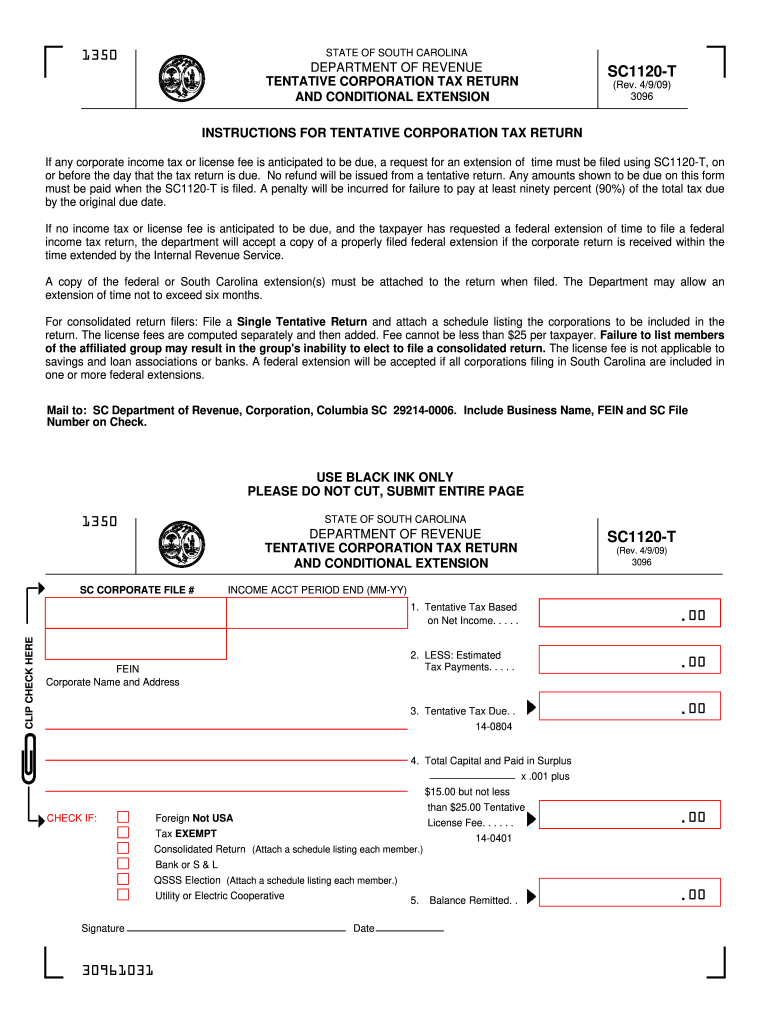

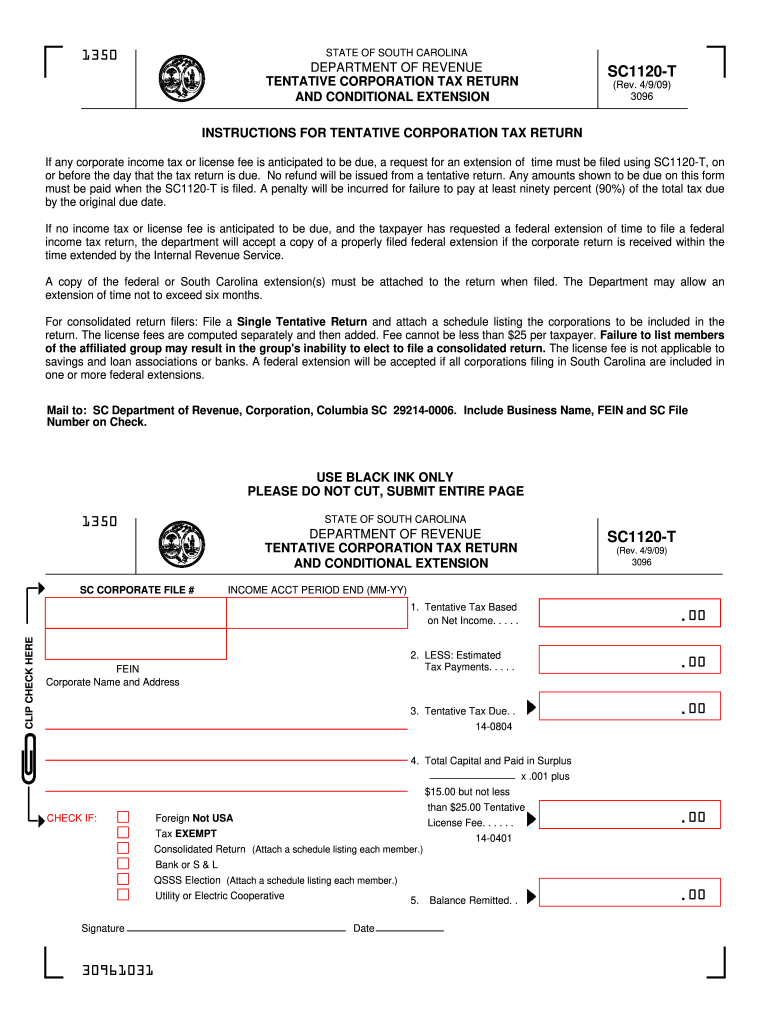

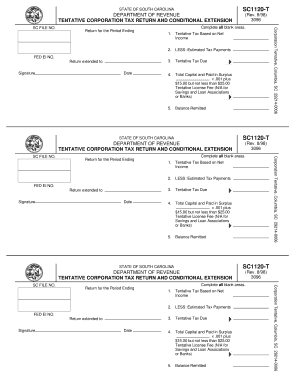

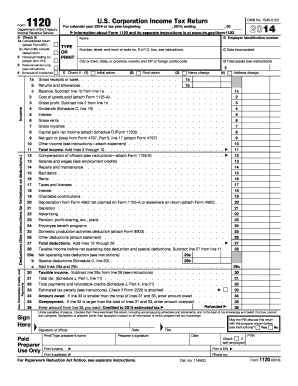

Form SC1120 is a tax return form used by corporations in South Carolina to report their income and calculate their state tax liability. It is similar to the federal Form 1120 used by corporations for federal tax purposes.

When filling out the SC1120 form, corporations need to provide various information including their federal employer identification number (EIN), legal name, address, and the date of incorporation. The form also requires details about the corporation's income, deductions, credits, and any tax payments made throughout the year.

Corporations must fill in the form accurately and legibly, making sure to report all applicable income and deductions in order to determine their tax liability in South Carolina.

Who is required to file fill in sc1120?

The SC1120 form must be filed by corporations that are subject to South Carolina income tax.

How to fill out fill in sc1120?

Here is a step-by-step guide to help you fill out Form SC1120, the South Carolina Corporation Tax Return:

1. Start by providing basic information about your corporation, including the legal name and address of the corporation, federal employer identification number (FEIN), and the South Carolina Secretary of State file number.

2. Part I: Income - Report your corporation's gross receipts or sales for the current tax year. Subtract any returns or allowances to calculate the total amount of income.

3. Part II: Cost of Goods Sold - If your corporation sells products, you will need to report the cost of goods sold. This includes the cost of inventory, direct labor, and other expenses directly related to the production or acquisition of the goods sold. Subtract this amount from the gross receipts to calculate the gross profit.

4. Part III: Gross Income - Combine the gross profit from Part II with any other sources of income, such as interest, dividends, rent, or royalties. This will give you the total gross income.

5. Part IV: Deductions - List and calculate any allowable deductions, such as salaries and wages, rent, utilities, advertising expenses, interest paid on business loans, etc. Subtract these deductions from the gross income to determine the taxable income.

6. Part V: South Carolina Taxable Income - Adjust the taxable income for South Carolina-specific modifications or additions as per the instructions provided in the form.

7. Part VI: Tax Calculation - Use the South Carolina Corporation Tax Rate Schedule to calculate the tax liability based on the taxable income.

8. Part VII: Credits - If applicable, report any tax credits that your corporation may be eligible for and calculate the total credits.

9. Part VIII: Payments and Refundable Credits - Report any estimated tax payments made throughout the tax year, including any applicable credits. This will help determine if you are owed a refund or if there is an amount due.

10. Part IX: Balance Due - If there is an amount due, calculate the correct amount based on the tax liability minus any payments or credits. If a refund is due, report the amount to be refunded.

11. Complete the Signature Section by providing the date, signature, and title of the person who prepared the return.

12. Attach any required schedules or additional documentation, such as Schedule SC Schedule UTP (Uncertain Tax Position Statement) if applicable.

Remember to review the completed form for accuracy before submitting it to the South Carolina Department of Revenue.

What is the purpose of fill in sc1120?

The purpose of filling in SC1120 is to report the income, deductions, and tax liability of a C corporation in the state of South Carolina. SC1120 is the state tax return form for C corporations that operate or have a tax presence in South Carolina. By completing this form, the corporation provides the necessary information for calculating its state income tax liability and any applicable credits or adjustments.

What information must be reported on fill in sc1120?

The SC1120 form is the South Carolina Corporation Tax Return form, and it requires the following information to be reported:

1. Identification Information: This includes the name, address, and federal Employer Identification Number (EIN) of the corporation.

2. Financial Information: This includes the corporation's total gross income, deductions, and taxable income, as well as any non-taxable income or adjustments.

3. Apportionment Factors: If the corporation conducts business in multiple states, it needs to report the percentage of its South Carolina business income relative to its total business income.

4. Tax Calculation: The corporation must calculate its South Carolina income tax liability based on the taxable income and applicable tax rates.

5. Tax Credits: Any available tax credits, such as job development credits or credits for taxpayers with disabilities, need to be reported.

6. Payment Information: The total tax liability, any estimated tax payments made during the year, and any applicable penalties or interest are reported in this section.

7. Declaration: The corporation's authorized officer or representative must sign and date the return to certify that all information provided is true and accurate.

It's crucial to note that this response provides a general overview, and requirements may vary in specific cases. It is always recommended to consult the official instructions and guidelines or seek assistance from a tax professional when filling out tax forms.

When is the deadline to file fill in sc1120 in 2023?

The deadline to file Form SC-1120 in 2023 may vary depending on the specific circumstances and regulations applicable for that year. It is recommended to check with the South Carolina Department of Revenue or consult a tax professional for the most accurate and up-to-date information regarding deadlines for filing Form SC-1120 in 2023.

What is the penalty for the late filing of fill in sc1120?

The penalty for late filing of Form SC1120 (South Carolina corporation income tax return) is calculated based on the tax due. The penalty is 5% of the unpaid tax per month, up to a maximum of 25% of the unpaid tax. Additionally, interest is charged on the unpaid tax amount at a rate of 0.5% per month until the tax is paid in full. It is important to note that penalties and interest can accumulate quickly, so it is advisable to file the tax return as soon as possible even if you are unable to pay the tax due.

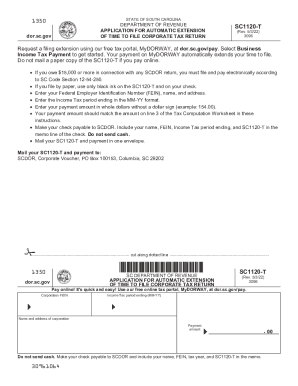

How can I modify fill in sc1120 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including fillable form sc1120 t. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete sc 1120 t online?

With pdfFiller, you may easily complete and sign sc 1120 instructions online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the form sc1120 t in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your sc1120 t form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.